This allows you to focus more on your core business operations.įactoring is not a loan hence it doesn't create debt on your balance sheet. The factor takes over credit control and collections, saving you time and effort in chasing payments.

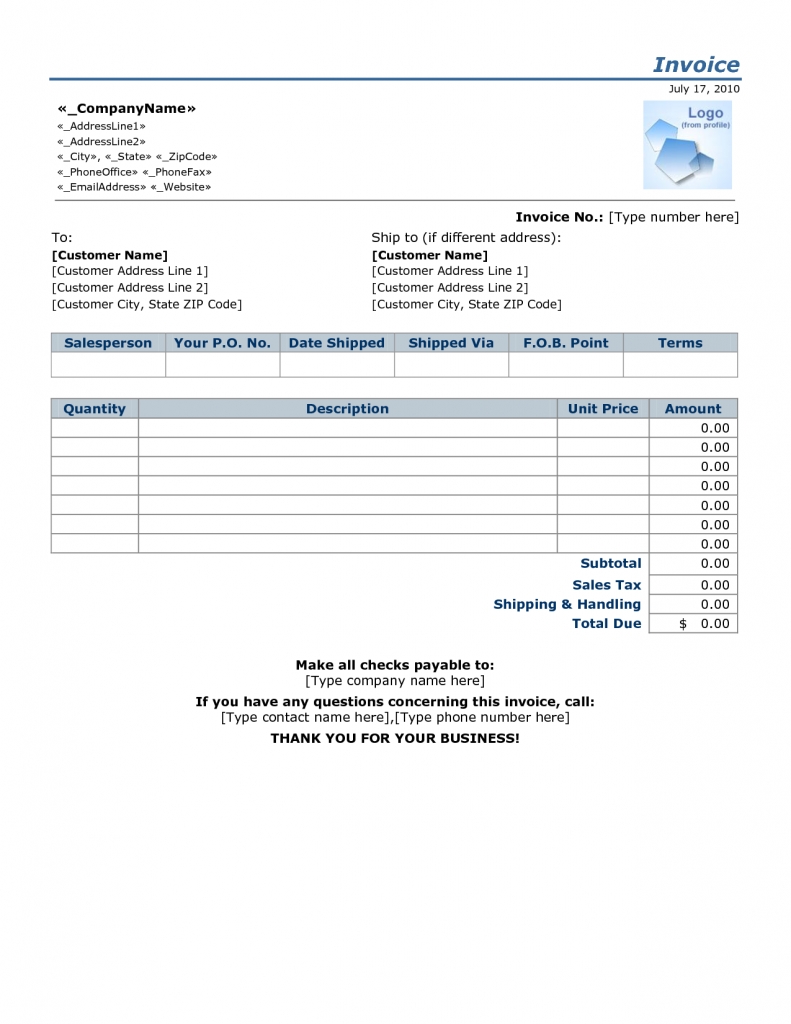

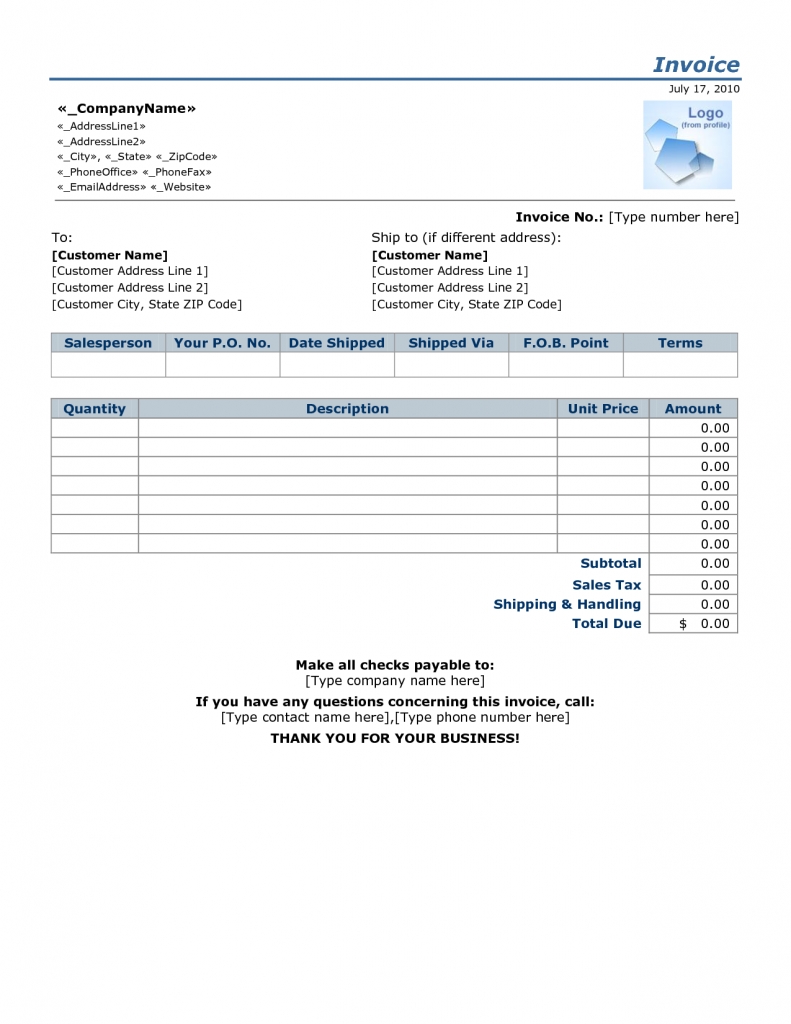

Once the customer pays in full, the factor pays you the remaining balance, minus a fee for the service.īy converting your unpaid invoices into immediate cash, factoring improves your business's cash flow, enabling you to meet operational expenses, invest in growth, or manage unexpected costs. The factor then collects payment directly from your customers. The factor pays you a significant percentage of the invoice amount immediately. You sell these unpaid invoices to the factor. Your business provides goods or services to customers and generates invoices. The factor provides you with an immediate cash advance and takes over the responsibility of collecting payment from your customers. Let's dive into this service and explore its potential benefits for your SMB.įactoring involves selling your business's accounts receivable (invoices) to a third party, known as a factor, at a discount.

Invoice factoring, also known as accounts receivable factoring, is a financial tool that can support your business's cash flow needs.

As a small or medium-sized business (SMB), maintaining a healthy cash flow is essential to your operation's stability and growth.

0 kommentar(er)

0 kommentar(er)